Impact and solutions of property taxes and rising values

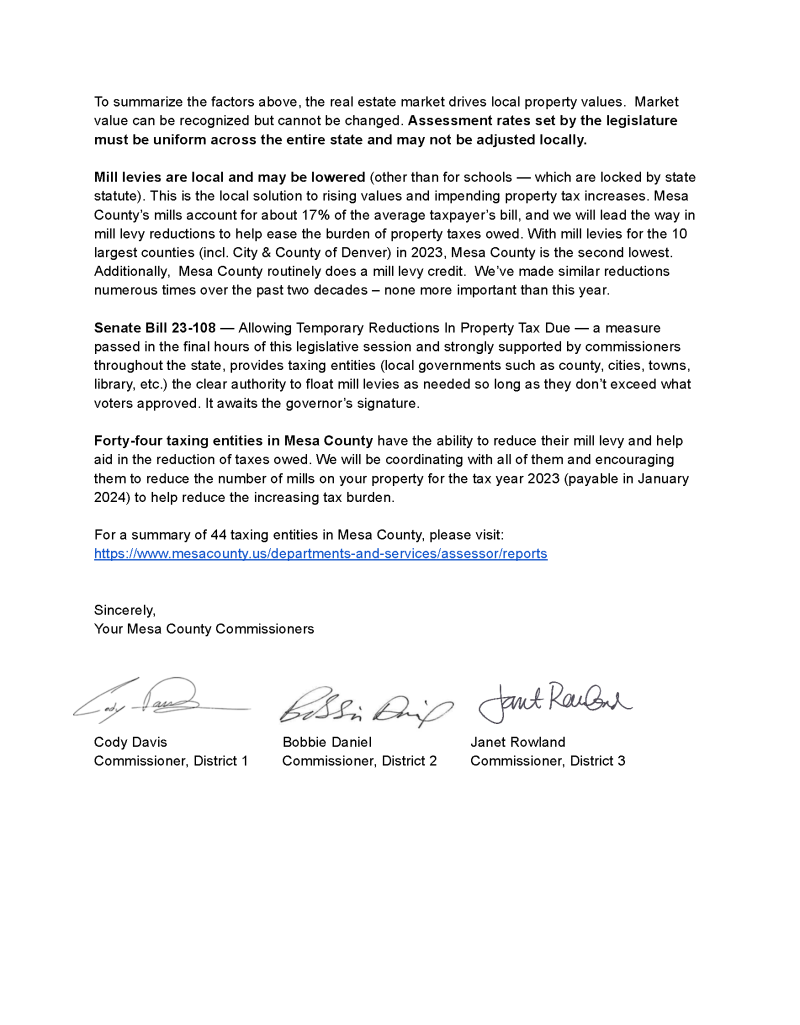

In Mesa County, residential property values have risen on average by 39% in the past two years, sparking concerns about the impact on property taxes among residents. These taxes are calculated based on three components: the home value, the assessment rate, and the mill levy.

Local market conditions influence the home value, and any disagreements with the new valuation must be filled by June 8, 2023.

The assessment rate, currently 6.765%, is set by the Colorado General Assembly. Mill levies, set by each taxing entity like county, towns, school districts, etc., are local and can be lowered (except for schools) to help alleviate property tax increases.

Mesa County will spearhead mill levy reductions to ease the property tax burden. Senate Bill 23-108, pending the governor's signature, will allow taxing entities to adjust mill levies as needed within voter-approved limits.

To reduce taxes owed for 2023, Mesa County will work with the 44 taxing entities capable of reducing their mill levy.

Read this open letter from the Board of County Commissioners explaining the action they will take.